Qualifying

Frequently Asked About Topics:

At Silver Leaf Financial Group, we have streamlined the mortgage application process to empower our customers on their homeownership journey. The application process itself does not take very long. Once we have an online application and income documentation, we are able to get an approval with one of our lending partners within 24 hours. Here is a typical customer journey for our purchase clients:

Our approach is tailored to individual client needs to ensure they understand and are in full control of the process. The customer journey begins once a client has reached out for a preliminary or discovery conversation. Become a Silver Leaf client today to benefit from our experience and superior attentiveness.

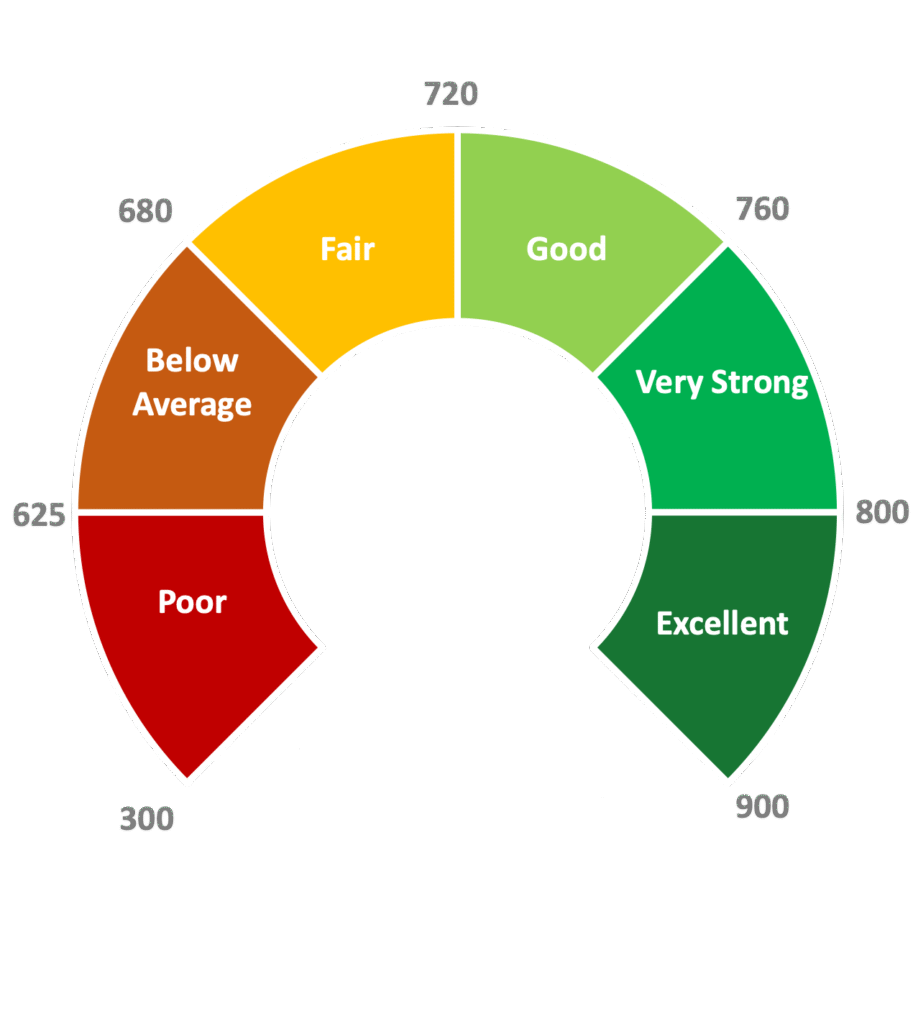

When you are applying for a mortgage, credit is one of the most important factors a mortgage lender will consider as they are decisioning an application. Credit scores are important to Banks and Mortgage Finance companies because your credit history is an accurate predictor of your likelihood to repay the mortgage as agreed. Your score can range from 300-900. Here are the different ranges of credit scores and where they stack up: Preserving strong credit is important because it ensures that you can qualify for the best rates and the mortgage amount you are requesting. If you have poor credit, while a prime lender may not approve your application, there are several financial institutions who lend to borrowers with bruised credit history. In these scenarios, we can set up a short-term mortgage while we work with you to repair your score and move the mortgage back to a Bank or Mortgage Finance Company as soon as possible. The rates for bruised credit are higher, but still reasonable.

Preserving strong credit is important because it ensures that you can qualify for the best rates and the mortgage amount you are requesting. If you have poor credit, while a prime lender may not approve your application, there are several financial institutions who lend to borrowers with bruised credit history. In these scenarios, we can set up a short-term mortgage while we work with you to repair your score and move the mortgage back to a Bank or Mortgage Finance Company as soon as possible. The rates for bruised credit are higher, but still reasonable.

Even if you are not applying for a mortgage, credit scores are used to qualify credit card and auto loan applicants as well. It is crucial that you understand how your credit score is calculated to maintain it. Here are the 5 factors that determine your credit score and their respective weightings:

In summary, to sustain strong credit, or to improve low scores:

- Make all payments on time

- If you carry balances, keep the balances on each trade line below 30% of the available credit

- Have a good mix of credit products (car loan, credit cards, etc.)

- Don’t apply for credit too often

- Do not close dormant credit accounts – use them periodically and pay them off

Income is a very important component of a mortgage applications. Mortgage lenders want to ensure that an applicant is able to afford a particular property. They make this determination through a debt service analysis, which is a measure comparing your debts and the carrying cost of the home to your gross income. A mortgage lender will review documentation related to income to determine what amount is eligible to use. There are a wide variety of income types and corresponding documentation that is required:

- Salary/Hourly Full Time

- 2 recent paystubs, a job letter confirming your guaranteed hours and salary/hourly amount, and your most recent T4

- Variable income (commission, bonus, tips, part-time, and overtime)

- 2 recent paystubs, detailed contract or employment letter, 2 year history of T4s

- Self-Employed

- 2 year history of full T1 Generals, Notices of Assessment, Articles of Incorporation or Business License, 2 year history of Financial Statements

- Other income is eligible for mortgage qualifying, requiring a 2 year history of full T1 Generals and Notices of Assessment

- Pension income

- Alimony and child support payments

- Government benefits including disability income, social assistance income, employment onsurance income support for seasonal workers, and some tax benefits (ex: Child Tax Benefit).

- Investment Income (usually confirmed with T5s)

- Rental income

A mortgage is qualified by assessing whether or not an applicant can afford the mortgage they are applying for. This qualification is called a debt service analysis where the mortgage lender reviews two debt service ratios: Gross Debt Service (GDS) and Total Debt Service (TDS). GDS measures the carrying cost of the house against your gross income. TDS measures all of your carrying costs of debt against your gross income.

Debt service ratios are not calculated at the contract rate, which is the actual rate you will pay. These ratios are calculated using the Mortgage Qualification Rate, also known as the Stress Test or Benchmark Rate. The stress test was implemented to ensure that an approved mortgage applicant can afford their mortgage if interest rates rise in the future. In most cases, debt service ratios cannot exceed 39% GDS and 44% TDS. Here are the calculations a mortgage lender will weigh against your gross income:

Silver Leaf Financial Group has access to all of the mortgage lenders in Canada who offer broker services. This includes Big 5 Banks (Scotiabank & TD), Schedule I Banks (Manulife, B2B, Equitable Bank, Home Trust, RFA), Credit Unions (DUCA, Meridian, First Ontario), and Mortgage Finance Companies. Mortgage Finance Companies are mortgage lenders who are only accessible through a Mortgage Broker. These companies, in contrast to a bank, offer one thing: mortgages. There are many of these companies in the market, notable names including First National, MCAP, RMG, CMLS and Merix. These are very stable and well capitalized lenders who are all approved by the Canada Mortgage and Housing Corporation.

Mortgage Finance Companies are excellent mortgage lenders. They offer competitive pricing, great features, and their penalty calculation for breaking a mortgage is a distinct advantage. Banks have “posted rates” that are significantly higher than the actual interest rate you can get from that Bank. The reason for this is that it allows them to charge high penalties if you need to break your mortgage early. Bank penalties are known as Interest Rate Differential penalties, whereas Mortgage Finance Companies typically charge 3 months of interest to break a mortgage early. This can result in savings of thousands of dollars in different scenarios.

At Silver Leaf Financial Group, we work with a number of different Banks and Mortgage Finance Companies. Having a strong network of lenders and relationships allows us to find the product and rate that best suits our clients.

Consumers are mainly focused on getting the best rate when they are shopping for a mortgage. However, what consumers should focus on instead is getting the best mortgage. Often, the lowest rates are low for a reason – they strip down all the features of a mortgage product and limit flexibility. When shopping for the right mortgage for you, ensure that the rate includes mortgage features, including:

- Term

- Amortization

- Rate Type

- Penalty-free Prepayment Allowance

- Payment Frequency

- Accelerated payments and Skip-a-payment

- Penalty Calculation for Early Repayment

- Portability

- Assumability

- Convertability

- Financing Costs

- Discharge Costs

Never apply for a mortgage without consideration for your long term financial plan. A mortgage is something that should fit within your long-term financial goals. For that reason, we partner with a group of financial professionals to ensure our clients are getting comprehensive advice and integrated mortgage planning. Selecting the right product, rate and lender is a critical decision. A great rate can save you a little bit of money on monthly payments but end up costing you later. This can be a very expensive mistake.

Over the past few years, there have been several rule changes that have affected mortgage qualifying and mortgage rates. These changes have tightened the lending rules and made mortgage rate offers more complex. As the lending rules have changed, it is more important than ever to seek advice from a mortgage specialist. Many of the low rates that are advertised are used as a bait and switch or for a product that restricts a borrower’s options.

The first question many customers ask when they are shopping for a mortgage is: what is the current rate? There is no one-size-fits-all rate for mortgages. Any mortgage rate offer will depend on your income, your credit, the transaction type, loan to value, purchase price, and amortization schedule.

The new rate environment is complex and constantly changing. While some shoppers are frustrated that they can’t get a straight answer about “current” rates, our priority is to find you the best rate and product for your circumstances. Remember, a bank is only able to offer you one set of rates. We work with dozens of institutions to place you with the lender that suits you best. Our job is to navigate the complicated rate environment to find the most competitive offer available on the market.